In 2017, the U.S. suburban office sector sparkles. And as with most facets of commercial real estate, timing has been everything. This recovery saw the spotlight shine first on central business district (CBD) office markets, and now, the suburban-office sector is well-aligned to future demographic trends and an evolving market performance that can potentially bring more upside to investors as this cycle perseveres.

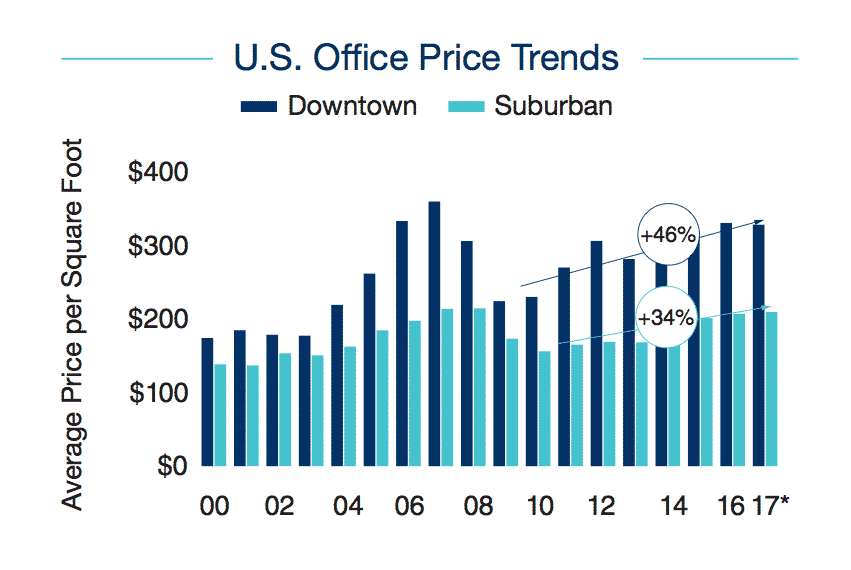

CBD office pricing looks moderately ahead of suburban office, but that’s not necessarily a bad thing for suburban-office investors. It means suburban-office investors might just enjoy a better return for a longer period of time. As of March 2017, national CBD office caps returned in the high-5% range, says commercial real estate services firm Marcus & Millichap, while suburban-office cap rates stand in the low-7% range. During this recovery (denoted as following the 2008 peak), CBD-office yields fell around 240 basis points, but suburban-office yields saw a 150-basis-point decline.

Suburban office vacancy has dropped roughly 250 basis points during this recovery, according to Marcus & Millichap, hitting 15% in the first quarter of 2017. Consider this in light of the fact that approximately 64% of households currently live in the suburbs, and that figure should increase as millennials journey onward to household formation. And although average suburban-office asking rent since 2008’s peak has grown 7%, this figure is still just one-half the average rent asked for urban office space. Lower land costs and increased demand mean companies and investors alike are choosing to relocate to the suburbs to develop the “live-work-play” environment much favored by office workers this cycle.

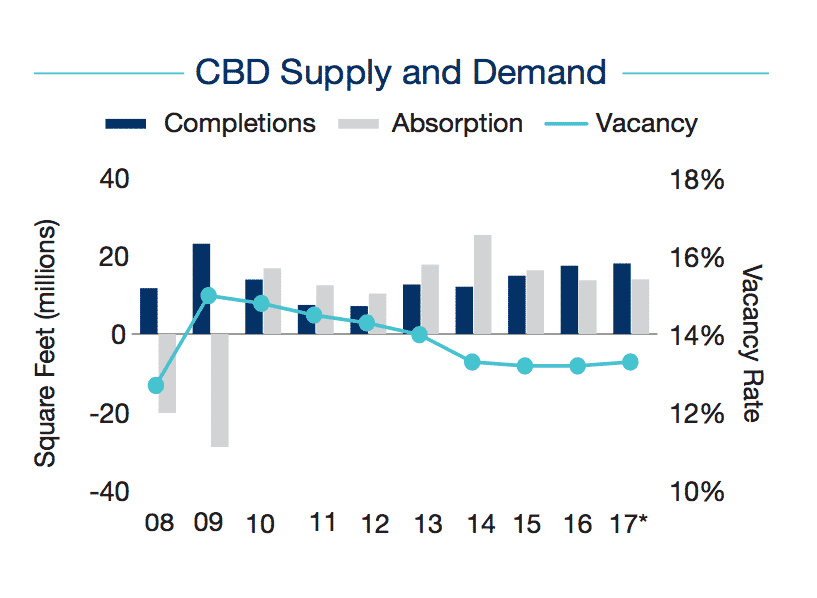

“In an effort to recruit and retain these employees, suburban tenants have been scouring the market for quality available space in locations near retail and transportation options. Subsequently, suburban office construction has heightened during the last two years but remains far below the completions recorded during the previous cyclical peak. Minimal completions and steady absorption signal the potential for further vacancy improvement,” Marcus & Millichap researchers write.

No more clearly do these trends present themselves than in Tempe, Arizona, and Plano, Texas. In these projects, office-using employees enjoy amenities that don’t make them feel like automatons.

Alliance Data, Frito-Lay, J.C. Penney, Pizza Hut and Toyota are among the tenants to set up shop in the Plano office campus, situated about 40 minutes outside of Dallas. (See my write-up on the J.C. Penney Plano redevelopment for National Real Estate Investor.) Of Toyota’s Plano-based North America headquarters, Marcus & Millichap writes that, “All departments are internally connected and collaborative areas comprise roughly half the workspace. Employees can choose to have standing desks, some on treadmills, and large community tables. The campus also has a wide range of amenities including various dining options, a jogging track, a rock-climbing wall and a two-story gym.”

And in Tempe, companies such as Freescale Semiconductor, Honeywell and State Farm count themselves as office tenants. Residential towers pepper the city — all located nearby local shops, restaurants and events, such as the Sunday-morning shopping, art and brunch pop-up Sixth Street Market. Transportation always a deciding factor, there’s light-rail with access to downtown Phoenix and Phoenix Sky Harbor International Airport.

State Farm’s Tempe office campus, for instance, includes an on-site doctor’s office, break rooms mimicking wine bars and coffee houses, standing desk options and a weekly music festival event called Beyond the Bricks, taking place every Thursday.

Talking Financials

The Federal Reserve, in its mission this year of modestly raising rates, must scrutinize current and resultant economic fundamentals… nonetheless how those apply to office real estate.

According to Marcus & Millichap, unemployment is at its lowest since 2007, and “yield on the 10-year U.S. Treasury bond remained in the low- to mid-2 percent range throughout the second quarter of 2017.”

Generally speaking, higher business confidence levels this year may push along rates of hiring. But it’s a delicate tightrope walk, that of juggling job creation, wage growth, and inflation — especially as the Fed embarks on what it’s deemed the “normalization” of its balance sheet.

Debt capital, however, remains hungry to invest, and underwriting remains disciplined, with Marcus & Millichap defining loan-to-value in the 60-to-75% range. As widely reported, deal volume has slowed… but should financial regulations loosen, additional lending capacity for commercial deals could follow.

This sector performance highlight was crafted using data from Marcus & Millichap’s special report, “Suburban Office Challenging CBD,” recently released for midyear 2017.