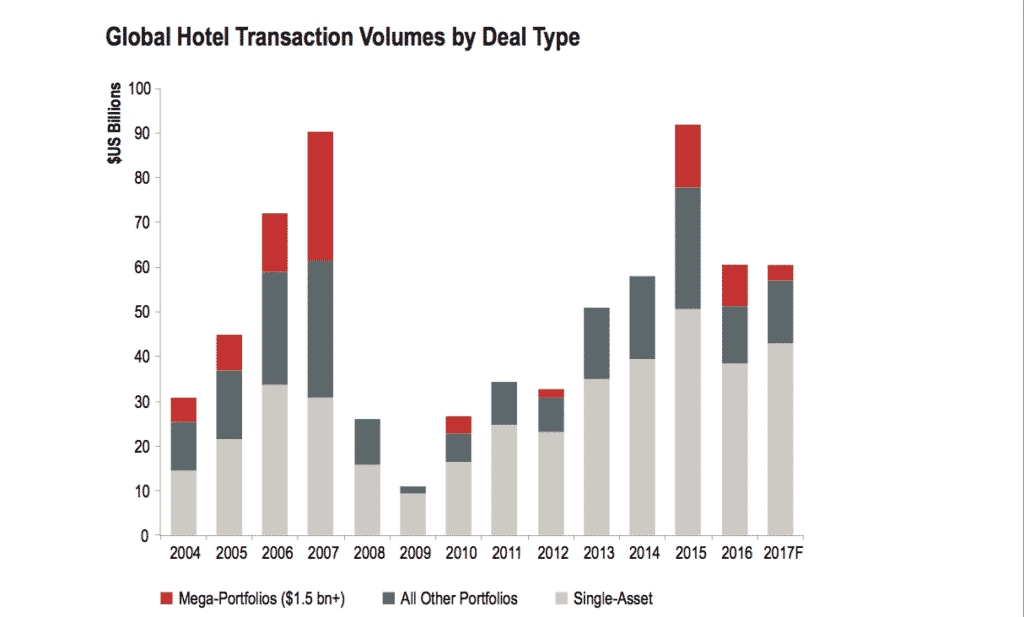

Nine years into the recovery, the hotel real estate sector is readjusting. This year, the sector should should expect an acclimatization of investment funds, involving in part a restrategizing on behalf of private equity, but just about full-steam ahead for foreign investors/cross-capital border flows…at least, according to the Hotel Investment Outlook 2017 published by commercial real estate services firm JLL.

Hotel transaction volumes for 2016 totaled $31B, and JLL forecasts that 2017 will be flat or a bit below that mark, garnering between $29B and $31B.

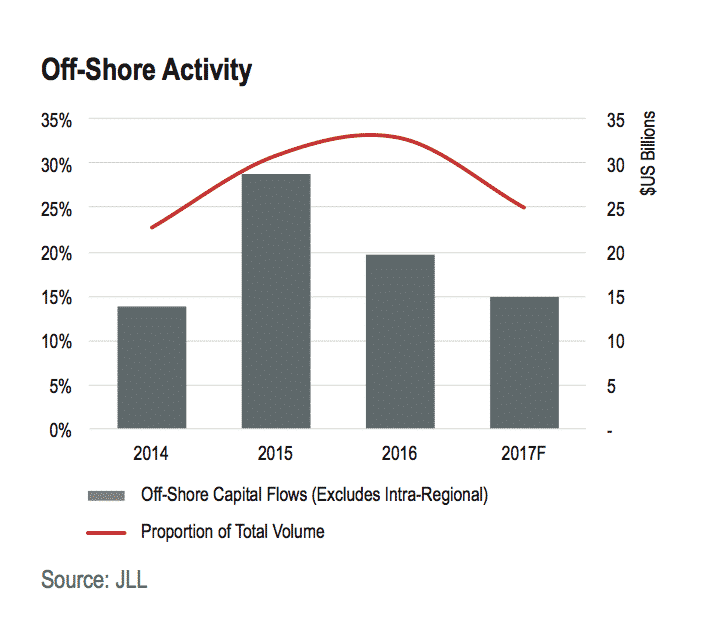

The share of cross-border capital peaked in 2016 reaching 33% of all deals, according to JLL. Global events have taken their turn macro-economically, in terms of how investors are allocating hotel-sector outlays, and this ratio is expected to decline this year.

Investors from mainland China comprised the largest class, chasing American hotel assets above all others. But the buying power of Chinese investors will be stressed by tighter capital controls imposed by the government for 2017.

American hotels accepted $14B in cross-border capital investment inflows during 2016, topping Europe. About $3.4B of cross-border capital was invested into Europe, followed by $1.3B in the Australasia region, and $.04B into South America. Breaking down outflows, $9.8B came from mainland China; $4.6B came from Asia proper; $2.1B came from the Middle East region; and North America invested $2B into other markets. Worth noting are the woes of nations relying on oil-production incomes — JLL estimates investment from Middle East nations to be flat this year.

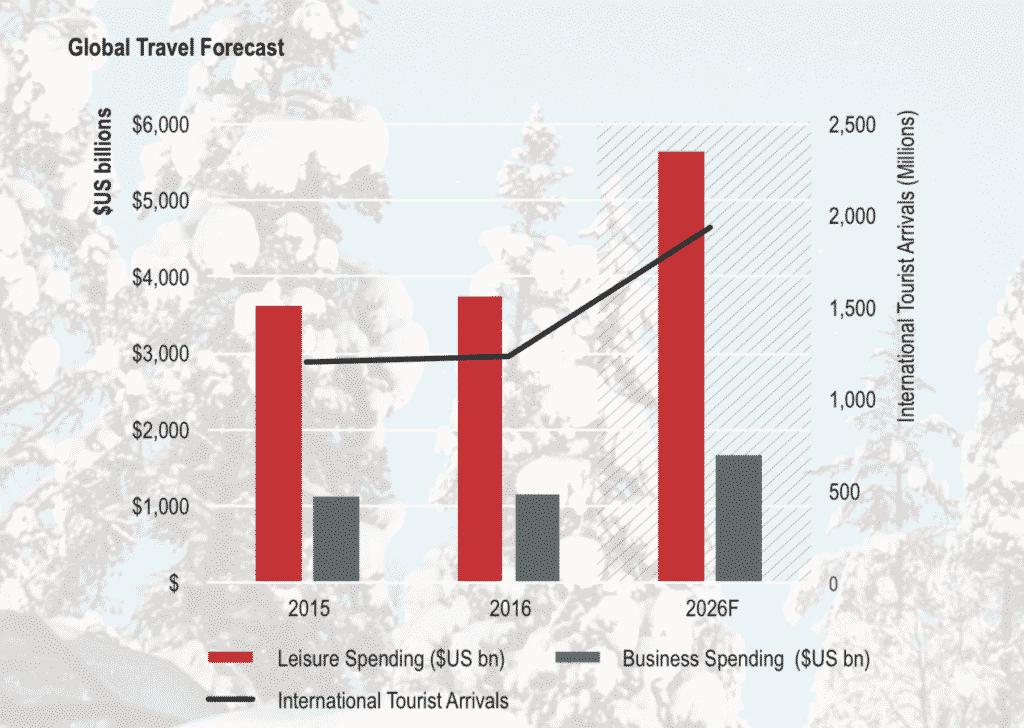

More so than ever, the pursuit of yield remains paramount. JLL says that 2017 is marked by “resets and changes,” and will lead to “a year of stability and greater consistency” of investment inflows.

But as transactions move into secondary and tertiary markets seeking yields, burps and hiccups will result. “Some markets where hotel performance has turned negative will see more stress in 2017, resulting in potential opportunities for buyers,” JLL researchers write. These markets include Houston, Miami and New York. Investors may fare better in West Coast markets and in Washington, D.C.,. JLL expects those cities to be strong secondary markets.

France, Belgium and Turkey are forecast to see impacts from terrorism. However, a trend among non-European nations took hold in 2016: Japan, South Korea and Vietnam recorded double-digit tourism growth.

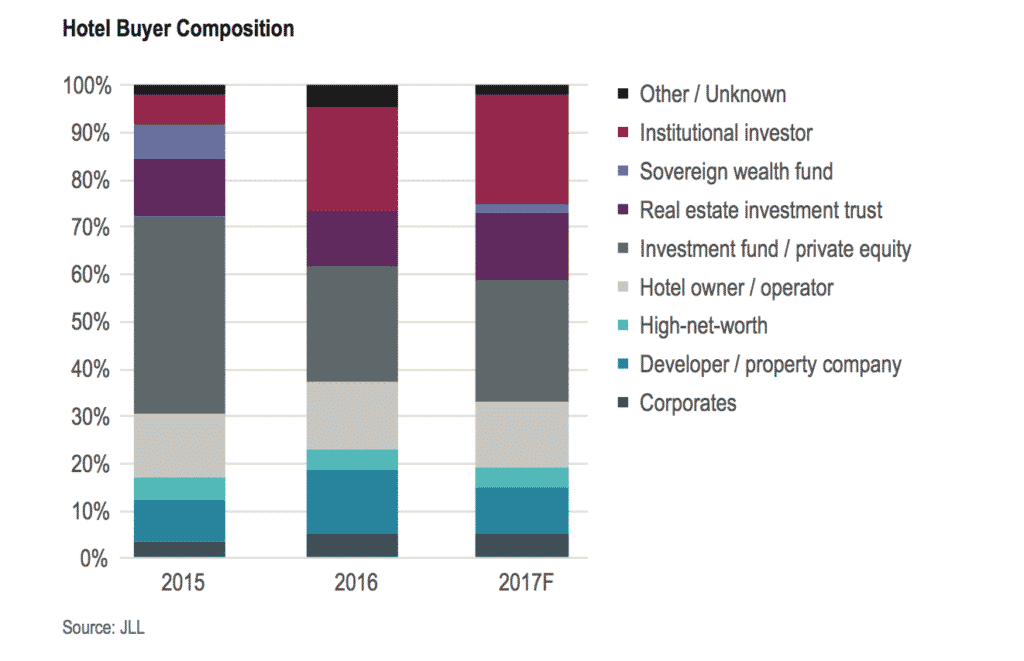

The issue brought forth for hotels in 2017 is flatlining EBIDTA. Pursuing yield outside of gateways is one solution that hotel investors have sought — but mergers and acquisitions (M&As) are another way to push company performance. Expect 2017 to be the year of consolidation, via M&A activity. Institutional investors jumped four-times investment in 2016 compared to 2015, embodying 20% of investors last year. Acquisitions increased to 40% in 2016, compared to 25% in 2015.

“Institutional investors’ buyer share is expected to stay strong in 2017; private equity buyers stand to see some increases. Particularly in the U.S., a partial re-emergence of private equity investors is on deck, with funds having raised capital to deploy. The role of private equity is shifting. In some cases, where they did sell big portfolios in 2016, [private equity] investors are staying in deals in a partial capacity. They continue to serve as portfolio managers when selling to long-term-hold institutional capital, which has less hotel real estate expertise,” say JLL researchers.