During its third-quarter 2017 earnings call on June 8, Ascena Retail Group announced it would undertake a fleet optimization program encompassing about 667 stores. The company is parent to a smattering of women’s and children’s apparel brands, including Lane Bryant, Dress Barn, Ann Taylor, LOFT and Justice Kids and runs over 4800 North American stores.

Of the 667 stores the Group flagged, 268 are slated for a hard close within five years, the company said in its Q3 FY17 Supplemental Earnings Package. Ascena says it will make decisions on the remaining 339 locations based on rent-concession and lease-term negotiations with its landlords. Although Ascena has been mum in specifying which stores are targeted by its fleet optimization program, a new report by credits ratings and research firm Morningstar Credit Ratings has followed the money to shine a light on locations that could be financially problematic for the retail operator.

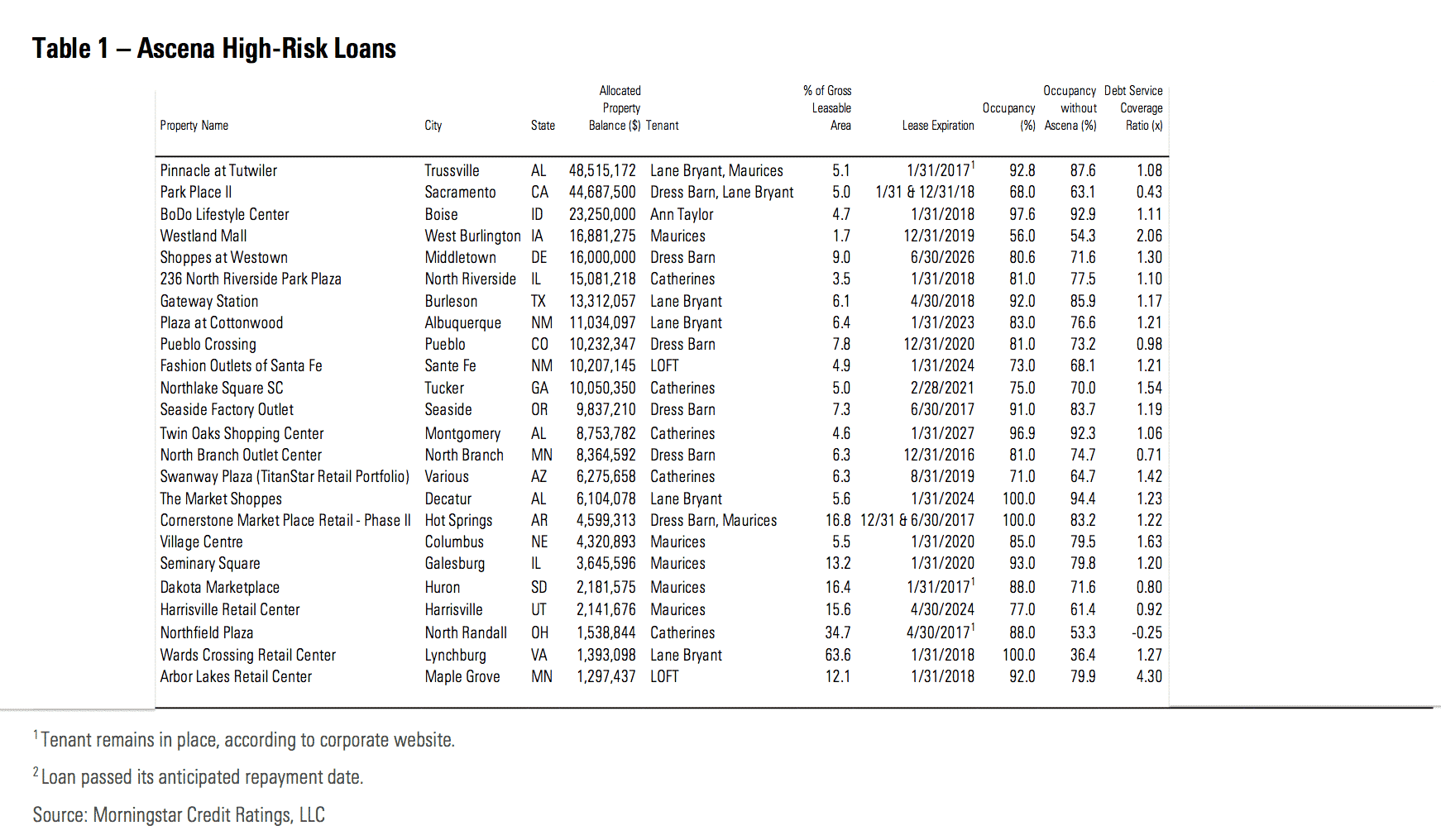

Morningstar Credit Ratings has identified 120 properties that secured commercial mortgages where Ascena Retail Group brands are among the five largest tenants. Those commercial mortgages carry an allocated balance of $1.73B.

Of the batch, 24 loans with a combined balance of $279.7B are most at-risk, according to Morningstar Credit Ratings. Among these 24 cases, some loans carry a debt-service coverage ratio below 1.25x. In others, the property’s occupancy could dip below 80% if the Ascena-owned retailer vacates.

The three properties that Morningstar has identified as carrying the biggest CMBS balance are: Pinnacle at Tutwiler in Alabama, with $48M balance; Park Place II in California, carrying $44M; and BoDo Lifestyle Center in Idaho, with $23M.

The three retail properties where Ascena brands occupy the highest percentage of gross leasable area are: Wards Crossing Retail Center in Virginia (63.6%); Northfield Plaza in Ohio (34.7%); Cornerstore Market Place Retail in Arkansas (16.8%).

Worth noting, however, is that most of these stores occupy a smaller percentage of gross leasable area; that may reduce risks for these landlords.

About 40% of the stores Ascena is targeting for its fleet optimization program are in malls, particularly class-B malls, while 33% are located in strip centers. By region, the biggest concentrations for program stores are in the Northeast (23%) and Southeast (23%). The operator has described plans to close its stores as a cumulative financial opportunity.

The number of stores involved in its fleet optimization program “will flex up or down over time,” the company says. In addition to the already-mentioned rent and lease concessions, Ascena says its assessment will factor in “realized sales transfer to remaining store network” and “sector demand consolidation (local market and brand-specific).”

Ascena Retail Group stock [ASNA] closed about 4% down on June 20, trading at $1.97 per share. Its stock price had rebounded slightly following the June 8 announcement, but has trended downward since June 13.