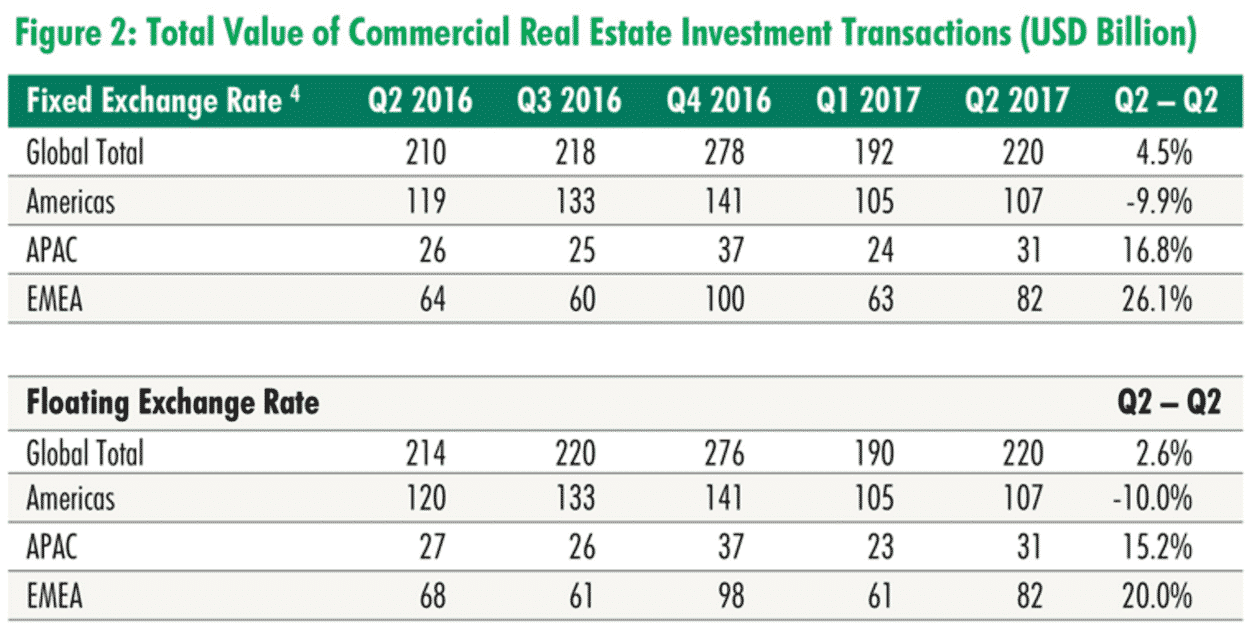

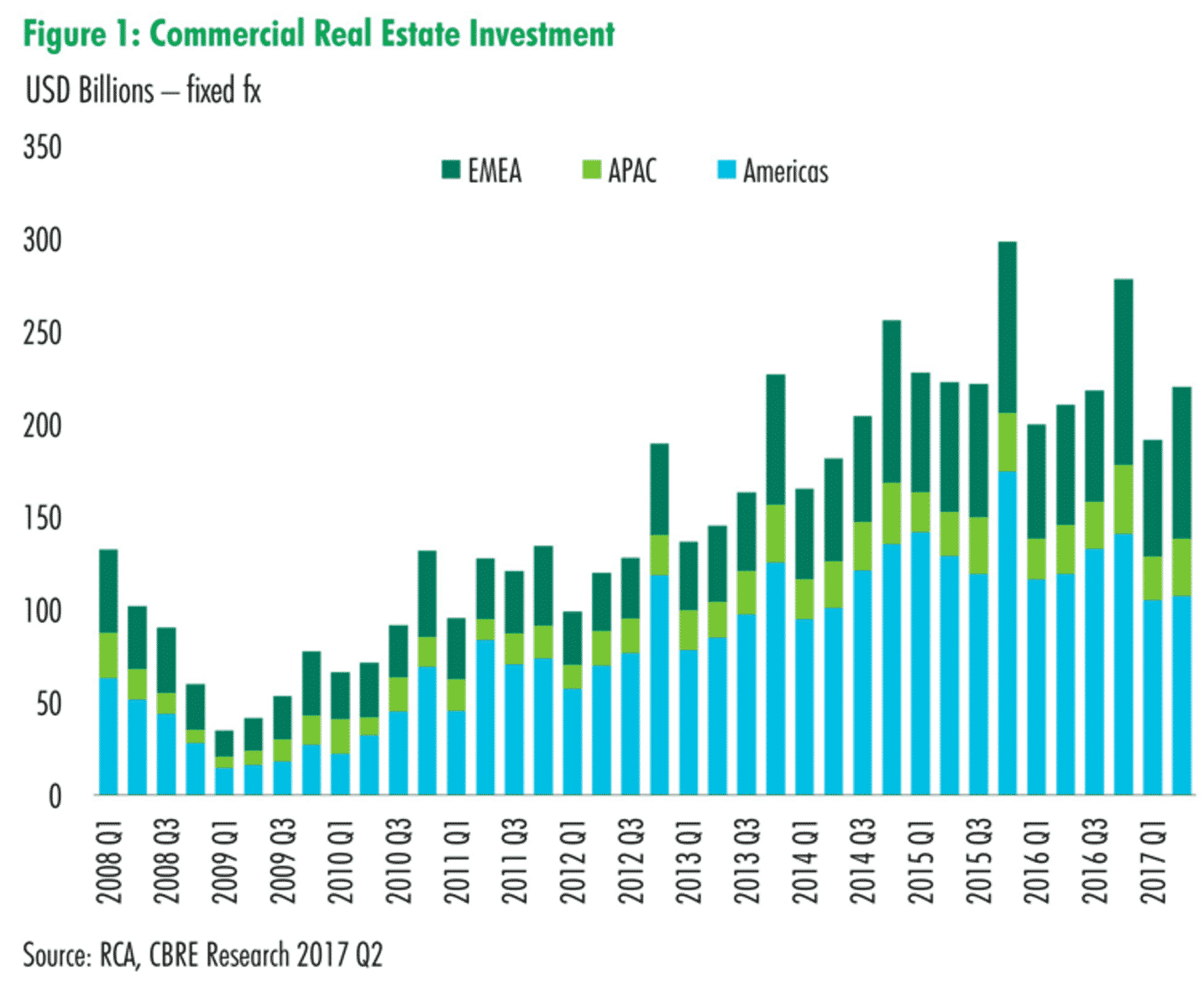

The global value of commercial real estate (CRE) transactions increased this year, but the Americas can’t take much credit for that growth. Global CRE transactions amounted to $220B in the second quarter, or 4.5% more than in the second quarter of 2016, according to commercial real estate services firm CBRE. Second-quarter 2017 CRE investment volumes within the Americas, however, fell 9.9% year-over-year.

CRE investment volume in the region comprising Europe, the Middle East and Africa (EMEA) jumped 26.1% compared to the same period as last year, bolstered by activity in the U.K and Germany. Meanwhile, CRE investment in the Asia-Pacific (APAC) region saw a respectable 16.8% boost compared to the same 2016 period. It’s possible that government-imposed capital controls have pushed APAC investment inward.

As it relates specifically to the U.S., CRE investment volumes are approximately 7.7% below Q2 2016’s figure. That still makes for the third-best second quarter since 2008, according to CBRE, falling behind 2015 and 2016.

The U.S. may be ahead of the rest of world in its financial recovery, but that means we’ll be the first to plateau as well.

“It looks like 2014 may have been the peak of sentiment. That doesn’t mean that we won’t see it push upward again. But right now, we are seeing a modest softening in investor perspective,” John Chang, first vice president of research services at commercial real estate brokerage Marcus & Millichap, was quoted as saying in a recent CRE investor sentiment survey.

Transaction volume in 2017 continues to slow, dropping 5% in the second quarter compared to the same period in 2016, according to commercial real estate data firm Real Capital Analytics (RCA).

Assessing deal volume in the first half of this year, RCA Senior Vice President Jim Costello wrote on the company’s blog that, “For the first half of 2017, activity was down 8% versus a year earlier, though some sectors fared better than others. Both prices and deal volume for hotels, suburban office and industrial assets in the Non-Major Metros climbed in the first half of the year. The retail sector in Non-Major Metros is suffering both on the price and volume fronts.”

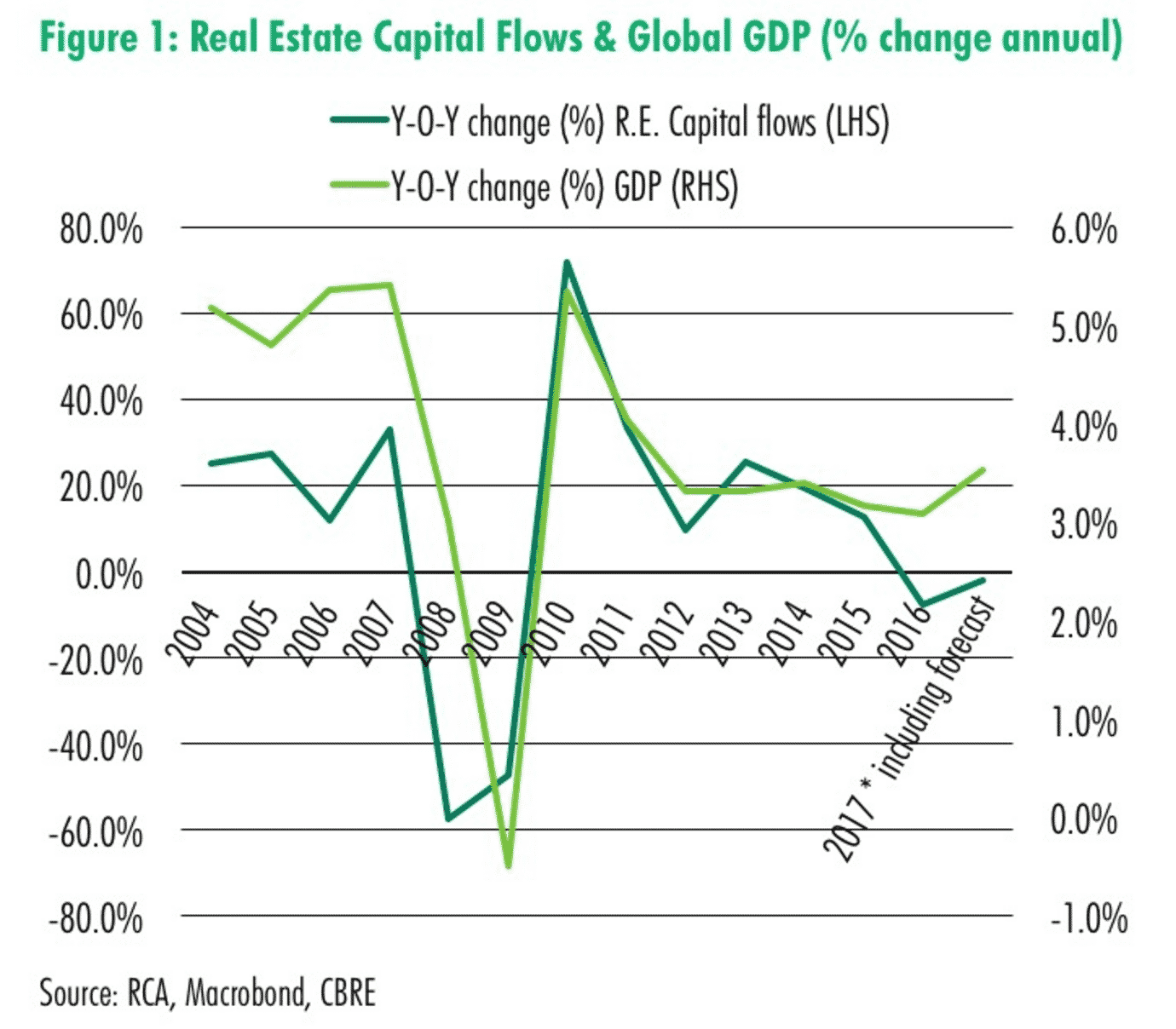

Following 2008’s historic recession, this commercial real estate cycle’s recovery has been difficult to predictably pace. Still, industry players generally remain positive. Investor discipline and lending constraint seen over the past nine years hopefully means than when this cycle does close, it won’t do so with some cataclysmic bang.

Modest global GDP growth this year will be a positive for CRE investment, according to CBRE, but in the U.S., investors will remain “wary” as they keep attuned to the upcoming roll-out of the Federal Reserve’s balance sheet normalization plans.

“The positives and negatives are evenly balanced, which suggests that the level of real estate transactions will be broadly similar in 2017, to what it was in 2016. In other words, the headwinds of the last five quarters have eased slightly and we have reached a plateau,” CBRE researchers wrote in their latest investment outlook.

“Despite the attraction of real estate as an investment, the annual volume of transactions is now at a much lower level relative to global GDP than in the peak of the last cycle. The level of transactions growth may be constrained by the increase in the marketplace of capital which has an ultra-long hold period,” CBRE said, but described “the recent cooling of the market” as “a very healthy thing.”